UPDATE: Amazon has responded with more information. Addendum to this article at the end.

Back in 2020/2021, Amazon rapidly released functionality and restrictions around “Restock Limits” and limiting sellers to send in only “Essentials”. Eventually, they loosened up to non-essentials with limits on how many units you can send in. I wrote an article about this in 2021 outlining this. The good news, this eventually was phased out and the floodgates opened. Keep in mind these are not the same as Capacity Limits that are based on the entire selling account, but are specific to certain ASINs on an account.

The bad news — Restock Limits are BACK.

Restock Limits Again?! What is happening?

Amazon has not officially announced new policy or new help pages explaining this at the writing of this article. The first evidence started popping up around April 8th (Maybe a tad sooner for some) 2025. So what do we know so far?

Example of one of the types of errors popping up: “You already have high days of supply for this ASIN in our fulfillment centers. This product must be removed from this shipment. Consider alternative low-cost warehousing and storage solutions such as Amazon Warehousing and Distribution“

Or: “ERROR: This product has a maximum inventory level and exceeds the allowed quantity. View the maximum inventory level on the Restock Inventory page” (Maximum inventory levels are not clearly defined on this page ironically)

Amazon is clearly bracing for impact. Prime Day, Fall Prime Day (October-ish one), Black Friday/Cyber Monday, and of course Christmas. Add in complicated tariff issues and delays at certain cross docks, Amazon is getting laser focused on maximizing their dollar. What this means is they want HIGH turnover. And in a general sense, this makes sense. Amazon does not want to be a storage facility. The problem is, the execution of broad policies on a catalog of 100s of millions of different products/ASINs leads to sweeping mistakes and over/under-correction.

How 2025's Restock Limits Work

Currently the information we know is that Amazon does NOT want more than 90 days of supply at Amazon. Easy right? not a big deal. Except, if you have been out of stock on a product for a while, are launching a new product, had a sudden increase in sales (due to promotion or viral events), or a multitude of other scenarios, sometimes 90 days of inventory in a snapshot in time is not actually 90 days of inventory. See example below.

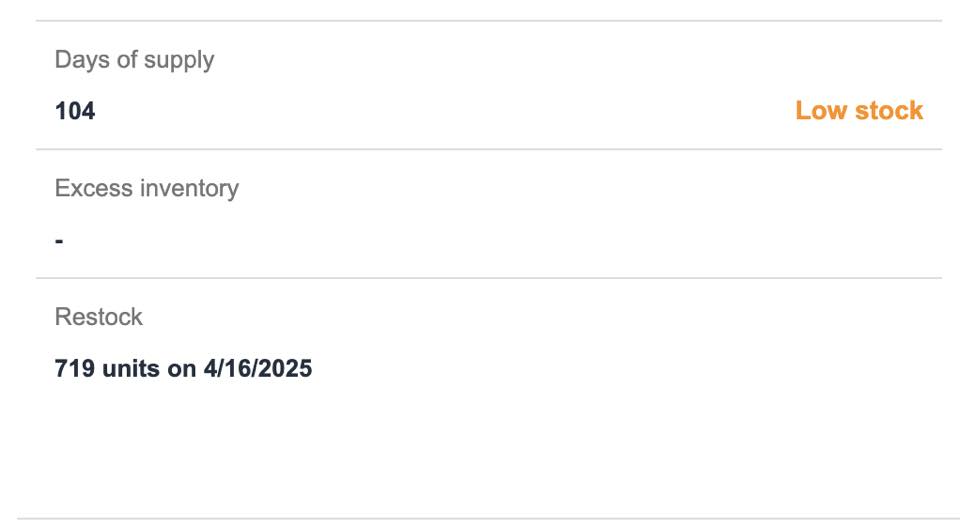

In the image above, this seller “has” 104 days of supply at Amazon. But this is actually false because the “Days of Supply function is a lagging indicator while the “Low Stock” flag is a forward-looking indicator. The reason I say “lagging” as this only truly adjusts after orders are fully processed and can take days or even over a week for true “averages” to balance out.

According to Amazon’s Help Page, the “Low Stock” flag show up: “for which the days of supply is less than the lead time. Low stock indicates that replenishment shipments may have to be expedited so that the item doesn’t go out of stock.” This means this “flag” is a Forward-looking Indicator and is a better reflection of future sales in most scenarios.

To add fuel to the fire, Amazon is also recommending to send in 719 units into FBA in 6 days. Currently, zero units can be sent in. And in 6 days, according to “Days of supply” we may still not be able to send any in.

Amazon is not factoring in LEAD times either. Spike in demand? I can’t inject my product into FBA warehouses in 24 hours. You can adjust your supply chain settings in the restock dashboard, but unfortunately those don’t seem to be affecting this new policy. As I wrote in my placement fee article, it can take weeks for product to get fully “settled in” into Amazon Fulfillment Centers (FCs),

Example 1: The Domino Effect*

Say you send in 100 units of Product A. Takes 2 weeks to get fully processed into FCs and it sells out in a week. You cannot restock this product until your Days of Supply metric “recalibrates”.

Now you are out of stock.

Now you can send in roughly ~1285 units (90 days based on 7 day sell through) right? Well yeah, but it is going to take a few MORE weeks of getting inventory into FBA after being out of stock again.

What if the actual sales velocity is around 30 units a day if well stocked? Now you are “actually” sending in only 42 days of inventory, but you may need to restock sooner. Oh no, now you get hit with Low Inventory Fees potentially!

Screenshot showing “over stock” and “low stock” for the same exact product — Completely contradictory metrics.

*The example above is only a “random” sample. It’s not indicative of every situation, but more to highlight potential issues as we all analyze the situation.

Example 2: The Meltable Effect

We don’t know if this will last in the same format or functionality through the rest of 2025. Assuming it does, Amazon’s recommendation for combating this was this:

“Best Practices for Seasonal Items:

– Send inventory in phases rather than all at once

– Start building inventory 6-8 weeks before your peak season“

1. The first part — Ok, not ideal if you need to ramp up quickly for Christmas rush of meltables, but fine. I’ll take it.

2. The second part? How are we supposed to “ramp up” for meltable season in November when you can’t even send in inventory before the meltable opening date?

Salt for your Wound

So you see some inefficient parts to the formula. Maybe you can manage some minor fluctuations. You might have a hard time on certain products that haven’t stabilized. But why not add more pain? During COVID, Amazon’s restock limits were SELLER specific. In 2025, these will be SELLER AND ASIN specific.

Seller Restrictions

Seller Specific limits are based on your 90 days of stock limitation. This is pretty easy to calculate as Amazon does some of the work for you on calculating. See the “How it works” section above for these details.

ASIN-Level restrictions

ASIN Specific is much scarier for those who are selling on listings with multiple sellers. Here is a direct quote from Amazon’s SAS Core team.

“1. ASIN-Level Restrictions:

– The days of supply is typically calculated at the ASIN level across all sellers

– This means that if one seller sends in large quantities of inventory for an ASIN, it can potentially affect other sellers’ ability to send in inventory for that same ASIN

2. Impact of High Inventory:

– Yes, if one seller floods an ASIN with inventory, other sellers might be restricted from sending in additional units

– This is because Amazon looks at the total inventory level for that ASIN across their fulfillment network“

I don’t think I need to annotate more to their statements except for the fact: How in the world can we factor in OTHER SELLER‘s forecasting into our restock quantities?! This means, and apparently already happening, you could be blocked from sending even a single unit in even if you have ZERO stock. Complete blockage from sending skus in means we are left blind to Amazon’s algorithm.

AWD as a backup? Hold up

We have already gotten confirmed reports, transferring Amazon Warehouse and Distribution inventory to FBA will NOT exempt you from these limits. Similar error messages show up on the AWD transfers in some cases, but this is currently inconsistent. (See image below)

But here is the fun part. Have a spike in demand? Not only do AWD to FBA transfers take up to 2 weeks, but they have a “smart storage program” where if you stay above 70 days of stock at FBA, but not over 90 days (to block new shipments), you get a rebate. Good luck balancing that.

Add in the fact that in Q4 2024, Amazon shut off the ability for sellers to send to AWD because they were full. Just more fun variables to keep in mind. We’ve personally see AWD’s “auto replenish” program to be so inaccurate that stockouts happened even for products without volatile sales growth.

Good news... ish.

Amazon has indicated some grace for certain seasonal products through the statements below.

“Seasonal Considerations:

– Amazon’s system takes into account seasonal sales patterns when calculating inventory limits

– However, you may need to plan ahead and communicate with Amazon about upcoming seasonal peaks

– The system might still show “high days of supply” warnings even for seasonal items

What You Can Do:

– Document your item’s seasonality in your case if you need to request a review

– Keep historical sales data to support your seasonal inventory needs

– Plan your shipments strategically to ensure you have adequate stock for peak season while avoiding excessive storage fees.

If you’re experiencing restrictions on seasonal inventory, you may want to contact Seller Support and explain the seasonal nature of your products, as they may be able to make adjustments to accommodate your specific situation.“

Not great, but something to take into consideration for those whom have inventory this would apply to.

Full Disclosure: Amazon is Amazon

This information was collected from social media, personal selling accounts of many sellers, communication with Amazon, and many other amazing sellers, agencies, and service providers who contributed to this summary. The only promise I can make is that Amazon is constantly changing. Statements made in this article are based on current data, information, and Amazon’s resources and can change at any time. If this is completely different in a more positive or even negative way, I will do my best to adjust the content for any significant changes. But on the flip side, I highly recommend starting to plan now. Often, Amazon does these changes in a “rollout” method. 100% of sellers don’t get affected at once. But if it works in Amazon’s favor, it is often a indicator to what is to come. I have cited multiple sources where I can in this article.

Now what?

We can all be frustrated or panicking, but in reality, what can we do? Most sellers I speak with focus on two things: Marketing/Growth (Brands) or Sourcing (Wholesale). These are critical for your business! Continue doing these. But please start doing analysis of your inventory, stock levels, turnover, and days of inventory per reorder. If these changes are permanent or they become more restrictive, the sellers who win will be those who are laser focused on their operations.

If you need help, advice, or want to contribute new information on this change of policy, please feel free to reach out!

Amazon's Response #1:

After this article was initially published, multiple statements have been made by Amazon through different channels. I will be breaking down the issues below.

Help Page Clarity? Not really.

Amazon directly responded to my post in the form of this message:

“Hey, we see a lot of chatter around the FBA product level shipment restrictions. Our FBA team has a help page here with additional information, and it’ll continue to be updated: https://sellercentral.amazon.com/help/hub/reference/external/GYJK3KL7KCFQHGBP. – Ron“

Let’s break it down! Most of this help page is related to Hazmat and other fairly normal inventory issues. Except one:

Amazon confirms “Sending excessive inventory … may … LIMIT OTHER SELLERS from inbounding inventory”. (contextually irrelevant words omitted for clarity).

Additionally, Amazon is referencing and recommending a Minimum Inventory Level help page to help sellers with maximum inventory levels. This makes no sense.

What is "excessive inventory"?

Amazon originally stated 90 days of cover. Well wouldn’t that be nice if it were true! The example below is a product that is currently under that threshold and is STILL being blocked from being sent in.

Amazon will likely now indicate this item needs to be charged Low Inventory Fees next week and we STILL can’t send inventory in. So what is it Amazon?

SAS Core: Correction or Contradiction?

Looks like I am on SAS Core’s radar. Time to deconstruct their statements so we truly understand Amazon’s policy.

Statement 1:

“I wanted to follow up regarding your questions about ASIN-level inventory restrictions and provide some important clarifications to the earlier responses you received. You’re seeing this message because Amazon has implemented temporary shipment creation restrictions for certain ASINs to help maintain efficient inventory levels in our fulfillment centers.

For more information, go to Managing FBA product level shipment restrictions.

This help page contains 6 reason codes explaining why a product may be restricted. I recommend reviewing each reason code to understand both the ‘why’ and the recommended actions for each code.“

Ok fair? So they have implemented new restrictions (See Help Page Clarity above) and the various reason codes. Nothing crazy.

Statement 2:

“However, I need to correct some important information about how this works. Days of Supply¹ is the estimated number of days that your current inventory will last based on the forward looking projected demand for your products². It accounts for your inventory in these statuses: Available, Inbound, and Reserved, and Unfulfillable¹. The forward-looking projected demand is estimated based on historical sales and expected customer demand². You can access days of supply metric on FBA inventory page.

Days of Supply Calculation

• It’s calculated for each seller individually

• Only your own inventory units and shipped units are considered in the calculation

• The metric updates weekly

• Your ability to send in inventory is based on your own sales history and inventory levels, not those of other sellers³

To directly address your question: No, if another seller has high inventory levels for an ASIN, it does not affect your ability to send in inventory. Your restrictions are based solely on your own metrics.³“

1. Days of Supply is a slight clerical error. Only Total Days of Supply factors in inbound product which should be the correct term. Currently the algorithm will block ASINs that exclusively have “inbound” more than the 90 days of supply metric — even if that metric hasn’t been re-adjusted to real sales. Amazon is including inbound product into their capacity limitations – which, it’s their platform. Not much can be said about that. Additionally, this metric does not include unfulfillable inventory as per this Help Page.

2. “Forward looking projected demand for your products … using Historical and Expected customer demand.” – I believe this is in direct reference to my article statements above. First, the metric is a forecasting metric, of course it is forward looking. But that forward looking is only factoring in your data. Which means if you send in 30 units for an item you haven’t sold in a while (even if all 30 sell in 10 days), Amazon is restricting the restocking of this sku until you have greater than 1 week of solid sales data.

These units are all inbound. Amazon knows it is not enough inventory via the Low Stock flag, but the “Days of Inventory” metric is not factoring in “potential future sales”. Forward looking indicator + with a delay + only using data from recent past sales.

These skus have been out of stock for over 90 days due to supply chain issues. If they both start selling very quickly, I potentially will be blocked from restocking in time to stay in stock due to this new policy and then get hit with low inventory fees on the next run.

3. The big contradiction — Dear Amazon – is it based on our sales only or all sellers on an ASIN?! SAS core says one thing. Help pages say another. And evidence says “ASIN level”.

Sellers are complaining about not being able to send in any units on ASINs they have zero stock on.

The Mathematical Solution if Amazon wants it.

Amazon wants better turnover. Sellers want to send in what they need. But the math used is not appropriate. Let’s solve it for them.

1. Use Sales Normalization to determine stock-adjusted sales

Averages of historical data are bad if the data is not contextualized. If a product hasn’t been sold in the past 30 days and the product has been out of stock for the past 30 days, Amazon is treating this as 365+ days of stock. If a product only recently checked in, we are being penalized for the previous days it was not in stock by averaging those “0 sold” days even though no inventory was stocked.

Solution: Amazon should use both Average and Median historical sales while ignoring data with days of “Zero Stock”. Currently they do not ignore Zero Stock days. Zero Stock days should include any day where “Available” = Zero because Inbound, FC Transfer, and other statuses often make the products not buyable.

This item sells roughly 13 a day once out of transfer. If Amazon factored in projected demand, why is Days of Supply over 230 days? To avoid low inventory fees, we need to ramp up stock. But we are currently being BLOCKED from doing so because the data is not normalized nor forward “factoring”. Forward looking = predicts the future based on the past. Forward Factoring = adjusts the forecast based on potential future events (more stock).

2. Update Daily with Seller-Only data

Amazon is clearly flip flopping on their position. Allow sellers to forecast for themselves only. It is impossible to forecast against competitors or other sellers. Not to mention the potential abuse that could arise. Also why update weekly? Why do you update shipped quantities, potentially restricting more to be shipped in, instantly, but the rest of the metrics weekly?

Solution: Update all variables the Days of Supply and Total Days of Supply daily. Make a clear statement and remove all contradictions about “ASIN-Level” restrictions. Allow all sellers who have zero stock to send in a non-zero amount of stock.

3. Bonus: Tell sellers maximum inventory levels and what items are restricted

If you really must stick to existing policy, tell sellers when they can send more inventory in and how much? Currently you have to practically build out shipments then get rejected. Why can a product with 89 days get 10,000 units sent in, but 91 days get potentially blocked from a single unit being sent in? Why does a product with <30 days of supply get blocked from being sent in? Keep the case escalation path open for specific scenarios were stock levels need boosting and seasonality, but realistically, you are restricting sellers without visibility into what they can and can’t send in and how much/when. This data is not visible on the restock report pages.

My main focus with this article is to educate sellers and provide clarity for policies Amazon is being inconsistent and confusing about. If Amazon wants Seller perspectives, I have many. But expecting sellers to adjust to complex policy changes with lots of guesswork – very challenging.

Pingback: The 5th Why / OTDR Protected Missing / Restock Limits Back? – ASGTG – Amazon Sellers Group TG

Pingback: Amazon Seller Updates: Restock Limits 2025 & Tariff Responses

Pingback: Amazon FBA Capacity Limits 2025

Pingback: Trump Tariffs 2025: How It Affects Amazon Sellers | BQool Blog

Pingback: Trump Tariffs 2025: How It Affects Amazon Sellers - Teds Woodworking Review

Pingback: How Will Trump’s Tariffs Affect Amazon Sellers – Daily Deals